Under the Companies Act 2016, all registered and existing companies must lodge annual submission which comprise of:

Annual Return comprise of all company’s information such as the business activities, the location of the business, registered office, particulars of its director(s), companies’ secretary(ies) and members with its shareholding particulars in the company. All these particulars are to be submitted on the yearly basis within thirty (30) days of the anniversary date for the local company or in the case of foreign company, on their registered date.

By submitting the document, the stakeholders will be informed that the company is still exist at the anniversary or registered date for the year submitted. The information provided will usually assist the company’s stakeholders to form a general understanding about the company.

Financial Statements and Reports

The financial statements and reports contain significant information to be used by stakeholders to evaluate a company's financial health and earnings potential.

The director(s) of a company are responsible to maintain a system of internal controls and keep proper accounting and other records that will enable the preparation of true and fair financial statements of the company.

While the other officers of the company must ensure that the submission of financial statements and reports to be made within the prescribed period.

When is the annual submission timeframe?

The timeline of the submission can be referred to in the following table:

| Annual Return (AR) | |

Financial Statements & Reports (FS) |

|

Private Company |

Public Company | |

Private Company |

Public Company |

within 30 days from the anniversary of its incorporation date for Local company

within 30 days from the anniversary of its registration date for Foreign company

| | within 30 days from the

Financial Statements and reports are

circulated to its members | within 30 days from its

Annual General Meeting (AGM) |

What should I do before submission?

The preparer must ensure that any changes in companies’ particulars that happens before the anniversary date, should be registered and approved in the MyCoID 2016 system. This is to ensure that only the approved changes in particulars to be reflected during the downloading process of the Annual Return into the mTool.

For further clarification please refer to the

PD5/2018 - Lodgement of Annual Return and Changes or Updates of Particulars of a Company to be Lodged in the Annual Return.

What are the fees for the annual submission?

The submission fees is based on the status of the company as follows:

Companies Act 2016 - Schedule (Regulation 8) |

Fees (RM) |

Annual Returns (AR)

|

|

b. Public company |

150.00

500.00 |

|

a. Foreign company |

500.00 |

Financial Statements & Reports (FS) |

a. Private company | -

audited financial statements and reports

-

non-audited financial statements and reports

|

50.00

20.00 |

b. Public company | -

audited financial statements and reports

|

200.00 |

|

200.00 |

d. Certificate relating to Exempt Private Company (EPC) |

200.00 |

Exemption Application of AR & FS |

Application for extension of time (EOT) / waived lodgement / relief on FS or AR |

100.00

for each application |

Appeal to the Minister under section 27 or 247 of the Act |

300.00 |

Who can do submission?

Only the appointed licensed Company Secretary or Company's Agent can lodge the annual documents to the Registrar in the MBRS platform.

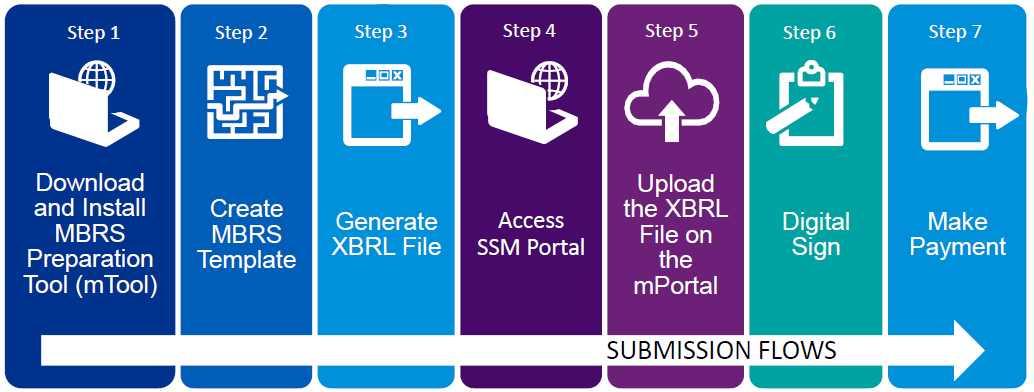

How to prepare for the submission?

The preparation and the submission of the annual documents can be made using the Malaysian Business Reporting System (MBRS). There are two main components of the system that is, the MBRS Preparation Tool and the MBRS Portal.

The companies are able to prepare the annual return and financial statements and reports, in the free application provided by SSM known as MBRS Preparation Tool (mTool).

- This is an offline application which allow the user to prepare for submission regardless of the internet availability;

- The basic validation of the data prepared can also be checked from the mTool itself; and

- Once the particulars from the validations approved, the system shall generate the XBRL file for submission purposes.

Unlike the mTool, the MBRS Portal (mPortal) must be access in the area where the internet coverage is available. The mPortal can be access through

SSM4U.

Apart from preparing the annual documents, the MBRS also allows preparation of the Exemption Applications (EA) related to the annual return and the financial statements and reports. For the full scope of MBRS filing, kindly refer to the

MBRS Summary Sheet for reference.

Who can have the access to the MBRS platform?

SSM are limiting different roles to have certain access in the MBRS platform. The Maker and Lodger functionalities is as described in the following table:

Who can be the

Maker?

Anybody appointed by the company secretary or the company agent can be the Maker. The Maker will usually assist in preparing the particulars for the annual submission.

Available functions for Maker in the MBRS: |

mTOOL |

mPORTAL |

-

May download the mTool;

-

May fill in information accordingly; and

-

May proceed to the validation process to generate XBRL filings.

| -

May upload the XBRL file to the mPortal. This functionality is only applicable once the Lodger successfully manage the association relationship from his / her end; and

-

May check the filing history.

|

Who can be the

Lodger?

Only the appointed licensed company secretary or the company agent can be the Lodger. The Lodger should ensure that the XBRL files submitted are prepared according to the Companies Act 2016, its Rules and Regulation.

Available functions for Lodger in the MBRS: |

mTOOL |

mPORTAL |

-

May download the mTool;

-

May fill in information accordingly; and

-

May proceed to the validation process to generate XBRL filings.

| -

Manage the association with the appointed Maker;

-

May review the XBRL File uploaded by Maker;

-

Shall approve or reject the XBRL File uploaded by Maker;

-

May digitally signed the XBRL Files;

-

Make payment and lodge XBRL File to the Registrar through the mPortal.

-

Apply rectification of AR and FS.

-

Check filing history

|

MBRS submission summary:

Does MBRS the only solution available for preparation of annual documents?

Since the MBRS submission platform is based on the

eXtensible Business Reporting Language (XBRL) format, all of the particulars regarding to the system are revealed especially to the software vendors. This is to encourage the developers to prepare an alternative system solution to suit the existing business operations by reusing SSM XBRL Taxonomy (

SSMxT 2022) and its explanatory

SSMxT Architecture document.

The SSMxT has been developed by SSM based on the guiding principles of the non-financial and financial scopes comprised of Companies Act 2016 and Malaysian accepting accounting principles that is Malaysian Private Entities Reporting Standards (MPERS) and Malaysian Financial Reporting Standards (MFRS).

Other useful information on MBRS

Download mTool Installer:

MBRS Portal (mPortal)

User Manual

Malaysian Business Reporting System (MBRS)

User Manual - MBRS Preparation Tool 2.2 (mTool 2.2)

PKI Registration / Digital Certificate

Frequently Asked Questions (FAQ)

PKI Registration / Digital Certificate